Cart Information

Printable Filing Checklist

- Home

- Printable Filing Checklist

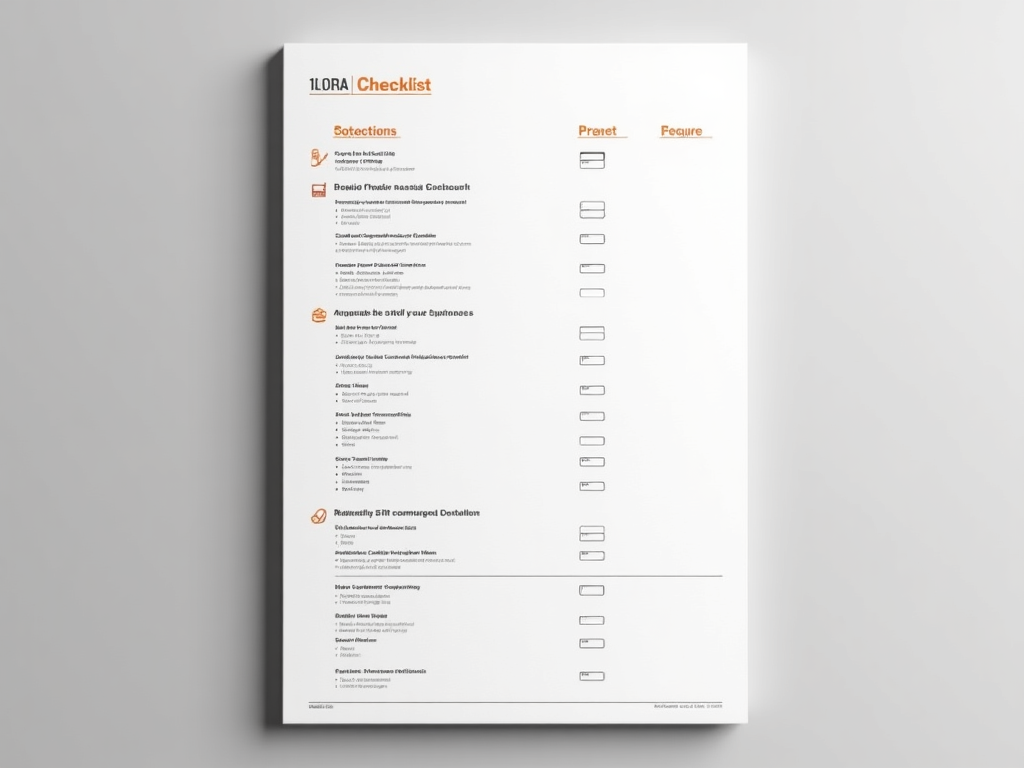

Printable Filing Checklist

The Printable Filing Checklist is an offline worksheet created to help Japanese crypto investors and traders stay organized during annual tax filing. It includes categorized sections for required documents, such as exchange transaction reports, wallet records, profit/loss statements, staking and mining logs, and proof of income from NFTs or airdrops. Users can tick off items as they collect them, helping avoid last-minute scrambling. The checklist also includes reminders about yen conversion methods, relevant filing deadlines, and necessary disclosures for overseas wallets. Ideal for use alongside tax filing software or accountant consultations, this checklist reduces the chance of omissions and missed deductions. It’s also formatted for easy printing and reuse year after year. Whether you’re managing a single wallet or multiple exchange accounts, this resource helps you streamline the complex process of crypto tax preparation under Japan’s tax regime. A must-have for self-employed crypto earners and long-term traders.

- Duration: Hours

- Lectures: 0

- Skill Level: Intermediate

- Language:

0 Reviews on Printable Filing Checklist